The Implementation of the Equator Principles in Bank of Taiwan

Bank of Taiwan (BOT) became signatories to the Equator Principles since 2022. To assess the E&S risk and implement risk management framework more efficiently, BOT set up Sustainable Finance Section within the Credit Management Department to serve as the primary unit responsible for drafting internal regulations related to the Equator Principles and reviewing Equator Principles cases. All corporate credit cases processed by BOT are required to be evaluated for their applicability to the Equator Principles, ensuring proper identification and management of environmental and social risks in our lending operations.

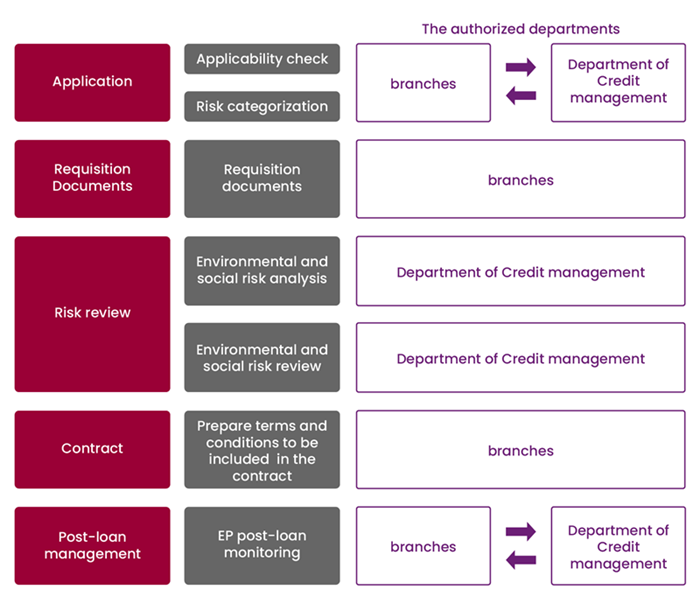

Credit process for EP projects

Comprehensive capacity building

To stay up-to-date with the latest sustainability trends, BOT actively participated in webinars and regional calls organized by the Equator Principles Limited and NGOs such as WECAN and BankTrack in 2023. Additionally, to familiarize credit officers with the processes involved in handling credit cases according to the Equator Principles, BOT has incorporated the Equator Principles and sustainability finance topics into credit business training courses and the bank's standard credit business curriculum, promoting awareness and understanding of environmental and social risks among staff.

Equator Principles Limited →