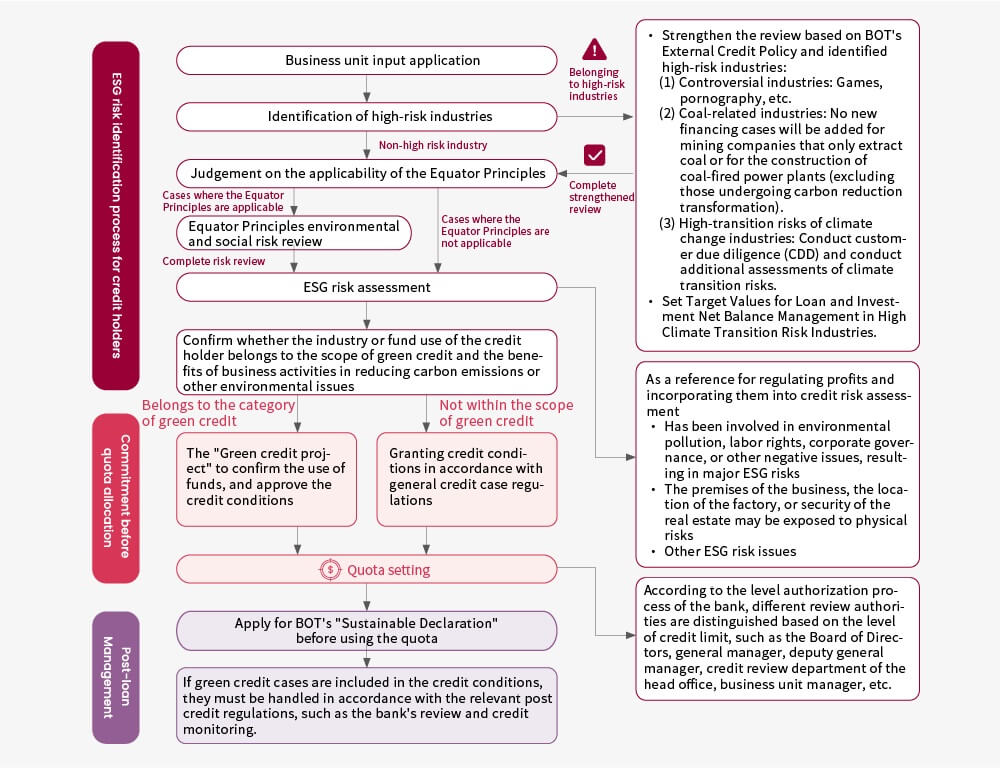

By establishing a sustainable credit policy and establishing a risk assessment and management mechanism for BOT's ESG, we aim to effectively control ESG risks and seize opportunities for sustainable development, including measures such as explicitly prohibiting BOT from speculative business, not adding new financing cases, actively supporting industries and economic activities, and strengthening review procedures.

The Regulations Governing Credit Extension clearly stipulate that when conducting all corporate credit review, it is advisable to review whether the credit holder has fulfilled its environmental protection, corporate integrity management and social responsibilities, so as to pay attention to the ESG risks of the credit holder.

In order to measure and manage the environmental and social risks caused by large scale project financing, the Bank of Taiwan follows the latest version of the Equator Principles guidelines and formulated these measures as the Equator Principles credit case risk management framework to align with international standards and steer enterprises to implement environmental protection and pay attention to society responsibility.

To leverage financial influence, encourage enterprises to invest resources through the core credit business, and promote a positive cycle of a sustainable society, BOT encourages customers to set performance indicators and goals based on their own industrial characteristics and the pursuit of sustainable development, and include them in credit terms. Regular inspections of achievements are also conducted to provide interest rate discounts.

By formulating sustainable investment policy, leveraging financial influence, and incorporating sustainable development goals into BOT's investment business, our company aims to jointly create ESG value as the principle direction of the investment business of BOT. Sustainable Investment Policy specifies the industries that are prohibited from investment and incorporates ESG factors into the investment decision-making process to effectively control ESG risks and seize opportunities for sustainable development.

Referring to the Sustainable Development Best Practice Principles for TWSE/TPEx Listed Companies formulated by the Taiwan Stock Exchange Corporation, BOT lists "Specific practices of corporate social responsibility", that is, "implementing corporate governance", "developing a sustainable environment", and "maintaining social welfare", of credit holder as a bonus in the credit rating form. The credit rating results are used as a reference for reviews and interest rate pricing.

Responsible Finance

Bank of Taiwan is committed to implementing responsible lending practices by incorporating ESG factors into the corporate credit review and post-lending management processes, including Know Your Customer (KYC) and Client Due Diligence (CDD) procedures. For significant project financing cases, BOT strengthen the review of environmental and social risks in accordance with the Equator Principles and maintain ongoing monitoring and transparency after disbursing loans, encouraging clients to adopt sustainable development practices.

Bank of Taiwan officially signed the Equator Principles in May 2022 and integrated them into its credit extension processes. By the end of 2024, the bank has managed two projects subject to these principles.

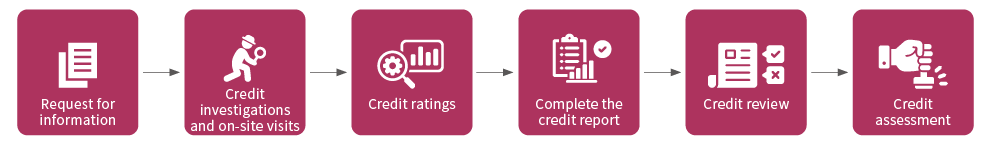

Responsible Finance Review and Management Process

| STEP 1: Credit Reporting |

|---|

| -ESG-related information disclosure

-Credit rating -Responsibility Credit Review and Credit Reporting Process  |

| STEP 2: Credit Review | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| -ESG inspection and evaluation of enterprise credit holders

-Sustainability-linked loan -Key inspection points for ESG checklist

|

| STEP 3: Post-loan Management |

|---|

|

-Credit Monitoring

-Communication and negotiation |