In response to operating risks of the financial industry resulting from climate change, Bank of Taiwan (BOT) released its first TCFD Report last year in 2022 and acquired the highest-level verification of the BSI. In the future, BOT will continually optimize and adjust data disclosure in the report, aiming to present its efforts and achievements in response to the challenges of climate change in a more comprehensive way. In 2023, the company continued to improve the transparency of information disclosure of physical risks and scenario analysis, and calculated the loss curve based on climate and rainfall scenarios. BOT adopted the methodology of the Partnership for Carbon Accounting Financials (PCAF) to calculate carbon emissions from invested and financed industries, expanded the scope of calculations, and regularly tracked each climate-related target, indicator, and actions, including mitigative and adaptative measures, thus showing the progress and commitment of BOT in climate governance, risk management, and sustainable finance.

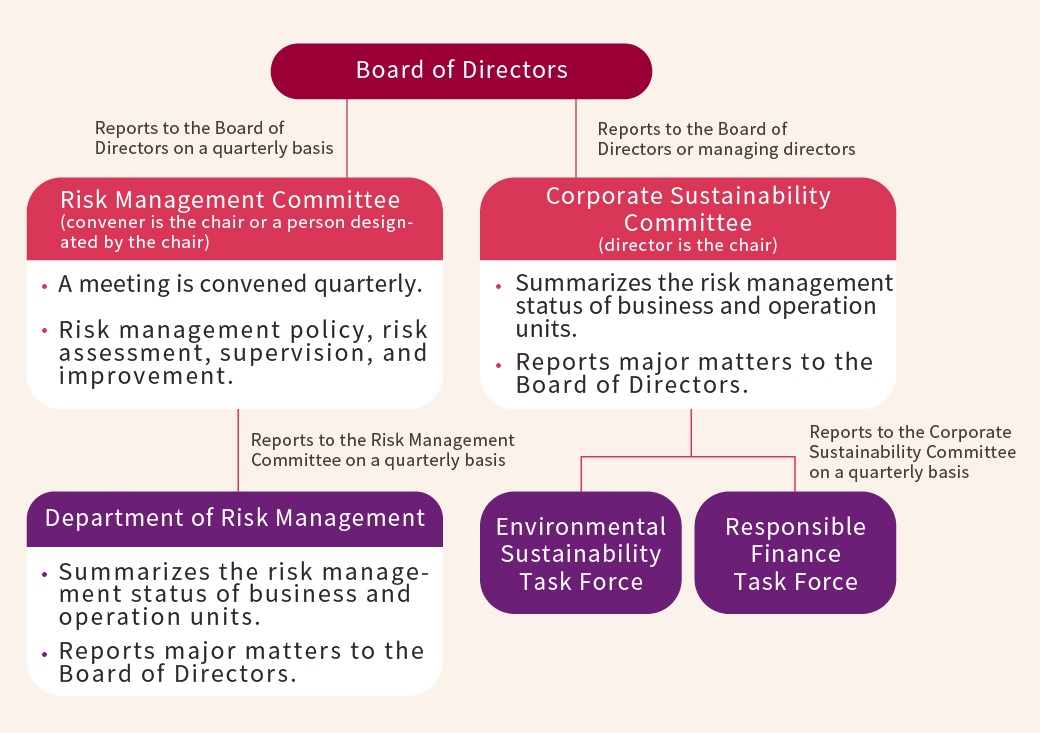

Climate Governance Structure Chart

Climate Strategies

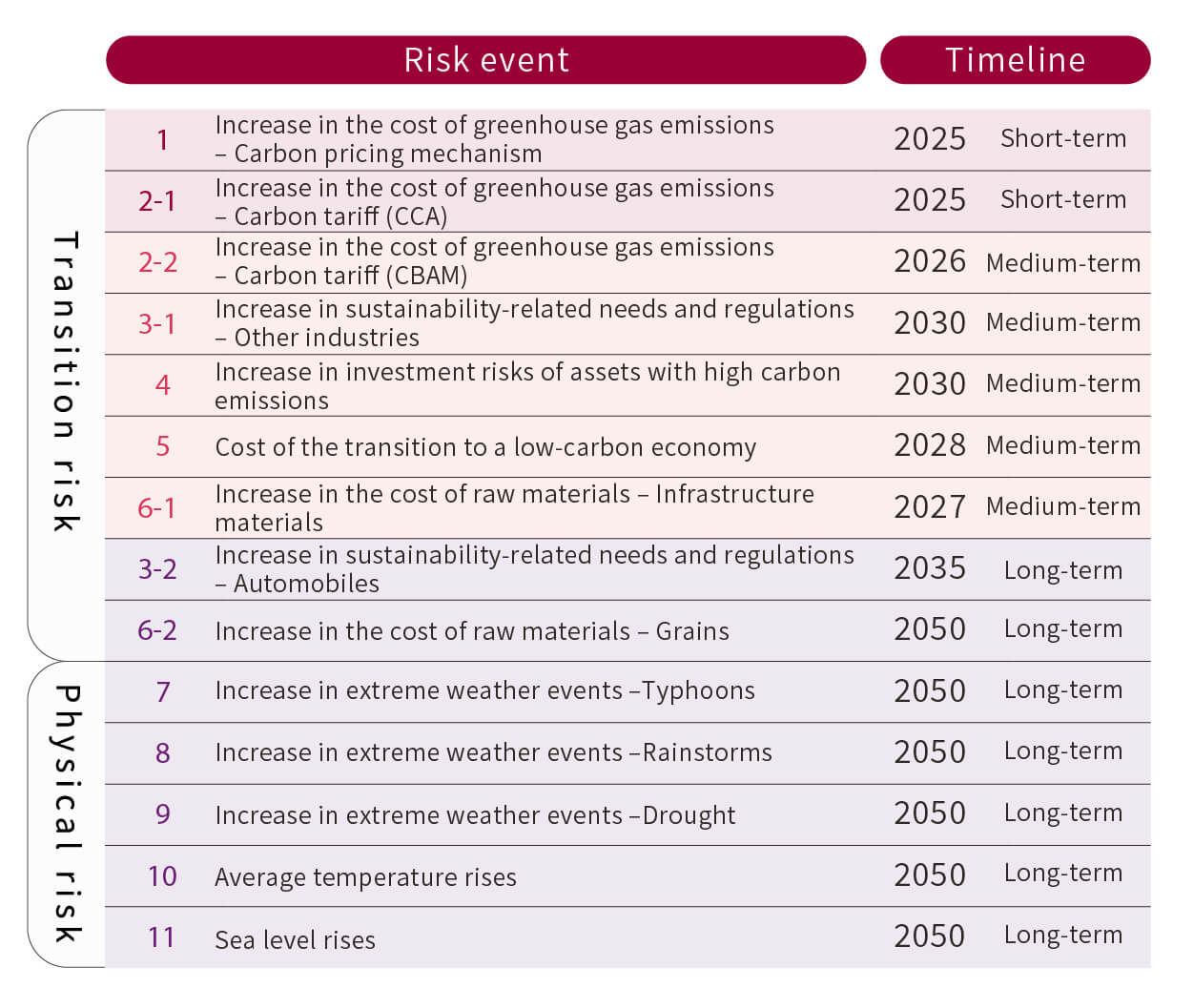

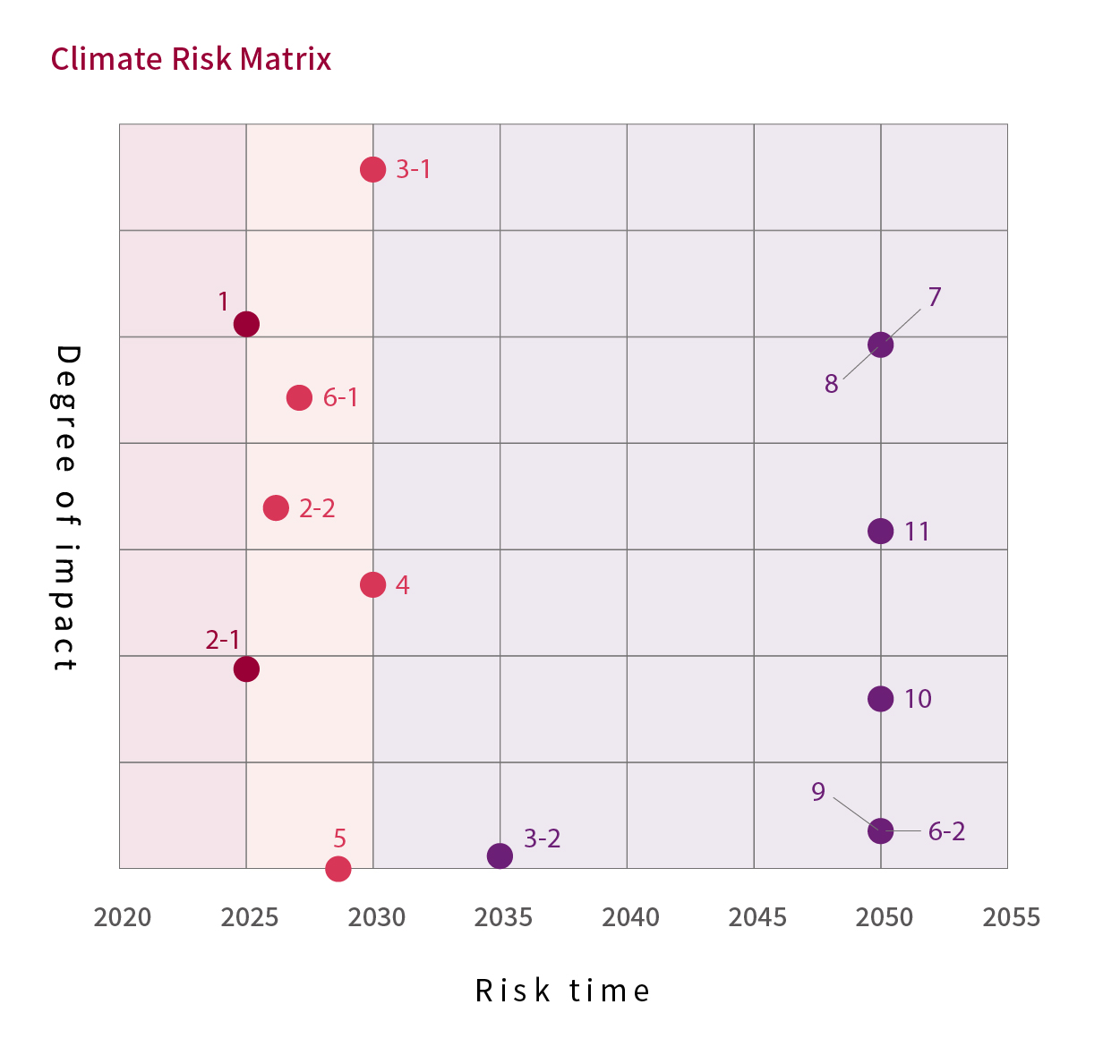

Notes:

1.Axis X-Risk time: Refers to the potential time that a risk event may occur and impact the Bank of Taiwan's business and asset positions based on current regulations, policies, or science-based climate projection.

2.Axis Y-Degree of impact: Refers to the degree of impact or influence imposed on BOT's business operations and assets when a risk event occurs.