We follow the Implementation Rules of the Internal Audit and Internal Control System to ensure strong business development, capital adequacy, and a reasonable risk return rate. The Risk Management Standards and Internal Operation Control Procedures serve as the key reference for risk management.

Risk Management Mechanism

To manage risks, we have set up a "three lines of defense" mechanism. The first line is guarded by the operations unit and business management unit, who are in charge of identifying, assessing, and controlling risks within the scope of their function and responsibility. The second line is held by Risk Management Units, Compliance Units and Business Management Units, who assess risk management regulations, assist and supervise according to each scope of the first line of defense with identification and control of risks, and current risk status, and make proper adjustments to countermeasures when necessary. The second line of defense also acts on abnormalities and reports to them to their superiors. The third line is the Audit Unit, which works independently and executes audits to ensure the implementation and completeness of risk management regulations and internal control procedure.

| Unit | Responsibilities |

|---|---|

| Board of Directors | The highest decision-making unit for risk management responsible for approving all BOT risk management policies in accordance with overall operational strategies and environments. The Board also monitors the effective implementation of risk management mechanisms and ensures sufficient capital is reserved to meet all risks. |

| Risk Management Committee | Convenes quarterly to coordinate cross-departmental risk management matters based on Board-approved risk management decisions. |

| Department of Risk Management |

|

| HQ Departments | Identify, assess, and effectively control risks related to all business matters, new businesses, or new products, formulate various risk management regulations to serve as the basis for implementation and review, supervise management of related risks by all units, and ensure management of all risks in collaboration with the Department of Risk Management. |

| All business units | Implement risk management procedures in accordance with BOT's regulations when conducting business. |

Risk Management Policy and Notification Mechanism

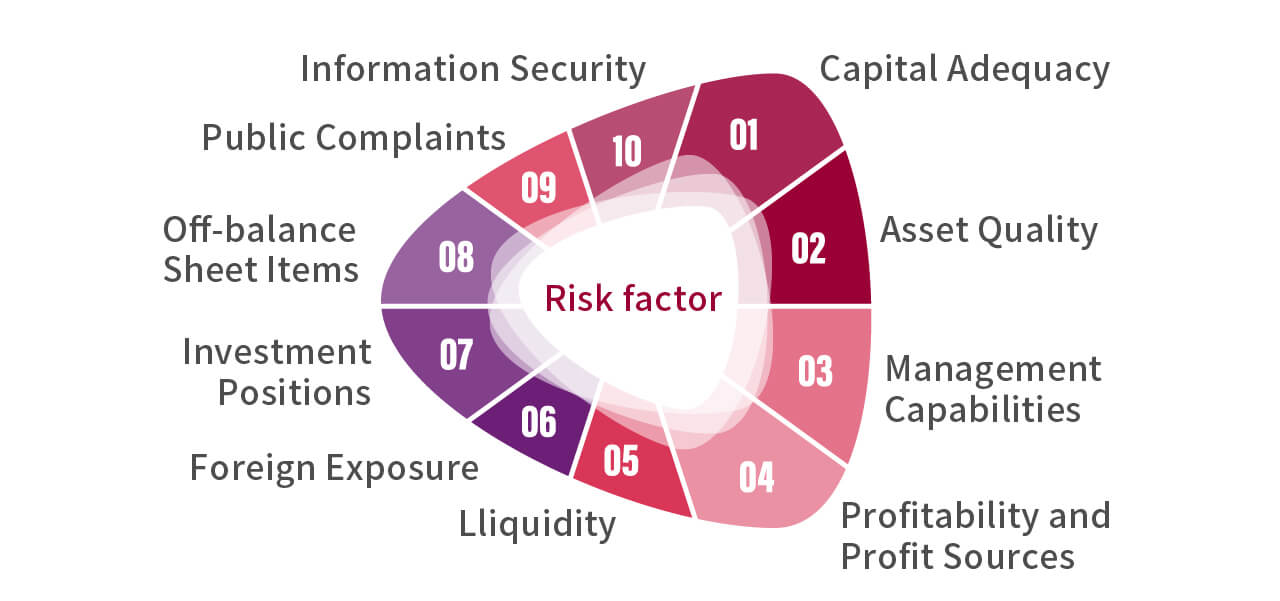

Under the Board, the Risk Management Committee follows "Risk Management Policy", and includes all risks on and off-balance sheet items under its remit. In response to emerging risks around the world, we also adopt mechanisms to regulate identification, evaluations, and countermeasures, ensuring effective response and management of applicable risks. We have adopted 11 business risk monitoring items and 22 monitoring indicators that reflect Article 2 and 3 of the "Regulations for Management of Detecting Major Business Risks".

In addition, to enhance our capacity to manage crises and emergencies, our regulations address crisis and disaster contingency plans, reporting procedures, and continuity of operations, ranging from internal control to significant events such as security maintenance, disasters, business issues, brand reputation, liquidity, information security, money laundering related transactions, strikes, and notifiable communicable diseases. When deemed necessary, we form a Crisis Management Task Force, Disaster and Emergency Task Force, and/or Emergency Task Force, and determine countermeasures in meetings to mitigate impact and redirect operations.

Risk Management and Identification

| Business managing units | Stay aware of important business information, operation oversight, changes to the financial environment, and detection results of monitoring indicators. Upon discovering numbers exceeding limits, the unit shall conduct an analysis and form countermeasures, and disclose such information in the report. |

| Department of Risk Management | Coordinates and business managing units includes quarterly submissions into the risk monitoring report for review by the Risk Management Committee and the board. |

Stress Tests

In recent years, the drastic progression of ESG has added uncertainties to business operations. Our "Regulations for Management of Stress Test" request voluntary stress tests quarterly to assess our risk assuming capacity against domestic/international economic development, COVID-19, inflation and rate increases, geopolitical risks, extreme climate events, and regionalized supply chains in a global economy. If test results do not meet standards, the Department of Risk Management may gather the heads of departments to determine countermeasures and improvement plans, and submit the proposals to the Risk Management Committee for approval. All four of the voluntary stress tests run in 2024 passed the minor scenario and severe scenario standard settings.

Voluntary stress tests

| Description | Achievements in 2024 |

|---|---|

|

|

Voluntary stress tests passed the minor scenario and severe scenario settings (10.5% Total Capital Adequacy Ratio, 8.5% Tier 1 Capital Ratio, 7.0% Common Equity Tier 1 Ratio, and 3.0% Leverage Ratio, per FSC standards). |

Stress tests reflect our progress in ESG execution and expected loss. We joined the Climate Change Stress Test Task Force under the Bank Association and completed a climate change scenario analysis for all banks in Taiwan per the FSC's instruction. The scenario analysis provided valuable insights into BOT's climate risk strategies, resilience and adaptability, and enabling us to make strategic adjustments accordingly. Please see 2024TCFD&TNFD Report for more information.

Raising Risk Awareness in our Culture

We integrate risk management into daily operations and transactions. The key is to establish awareness among all employee levels and form a strong business culture. In light of this, we initiated transparent, comprehensive risk communication mechanisms to guide risk information to upper and lower levels, as well as between departments. The information is disclosed to the public as a legal requirement.

| Measure | Description |

|---|---|

| Risk management trainings |

|

| Risk reporting measures | Established risk indicators and advance warning mechanisms, adopted appropriate risk monitoring mechanisms, and compiled quarterly reports submitted to the Risk Management Committee. |

| Measures for strengthening risk culture |

|